Resources.

LMI resources for home buyers, available in a variety of languages.

- Home

- Tools & Resources

- Lenders Mortgage Insurance - Old

What is Lenders Mortgage Insurance?

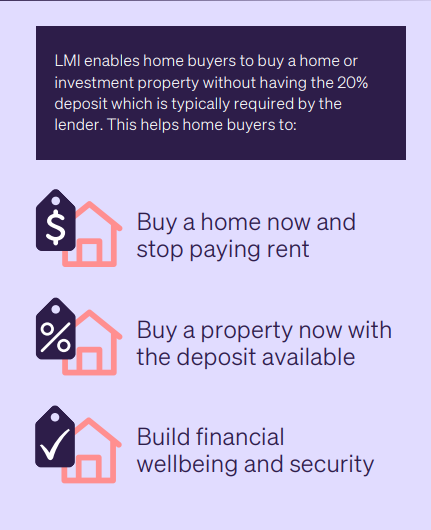

Lenders Mortgage Insurance (LMI) can help you accelerate your home ownership journey, and it can make it possible for you to get into your home sooner without having to save a 20% deposit.

Lenders Mortgage Insurance (LMI) protects your lender against the risk of potential losses, in case you are unable to make your home loan repayments, and the lender is unable to recover the outstanding loan amount from the sale of the security property. With LMI coverage, lenders are willing to lend more money to home buyers with a lower deposit.

This makes loans more accessible to people who are looking to buy a home with less than a 20% deposit.

A lender may pass on the cost of LMI to you. You have a range of flexible options for paying the LMI cost to your lender – either paying the fee upfront, capitalising the amount into the loan, or paying a monthly LMI fee.

-

We make it easier and faster for home buyers to own property.

-

We reduce financial risk for lenders.

-

We stand behind lenders and brokers, with flexible solutions.

-

We empower our partners to reach new heights.

-

We accelerate financial wellbeing through home ownership, now and for the future.

Access.

Cut through the complexity and reach your property goals faster with us.

So much information, so little time.

Property resources for you.

2023-2024 edition - it’s my home

Our ninth edition of it’s my home is here. This edition includes educational and lifestyle articles to focus on all stages of the home ownership journey. Whether the goal is saving a deposit, buying your first home, investing, refinancing or upgrading, our magazine articles can help navigate the complexities of the process.